Reading time : 3 Minutes

You See

FSI Not A REAL

U-TURN

Foreign Sourced Income is in power!

Many were confused

Truth : Conditional Exemption

There is no FULL U-Turn.

There has been a lot of confusion recently. Many thought there was a FULL U-turn on Foreign Sourced Income. We received many Whatsapp, so it is best to write to you to explain the actual scenario.

There are two significant facts to highlight :

(i) Finance Act 2021 – Published on 31 December 2021.

(ii) MOF issued Press Release on 30 December 2021.

Here’s what happens.

On 30 December 2021, MOF published a press release through Bernama . The news was picked up immediately by many mainstream media. Some media companies just picked up 1st paragraph of the press release and presumed it is a Full U-turn and published as it is.

This substantially misleads the public and business community , thinking that it is FULL U-turn without further investigation.

Meanwhile, the more well-read media such as The Edge , Tax Firms such as PWC and even the Sun published the correct details.

TAXING FOREIGN-SOURCED INCOME IS NOW A LAW !

The Finance Act 2021 was published on 31 December 2021. It is the same as the Finance Bill 2021. Meaning that the Tax Law on taxing Foreign Sourced Income is now IN POWER, and it is the same as what we understood in Budget Announcement.

The Twist…

The ACTUAL U-TURN

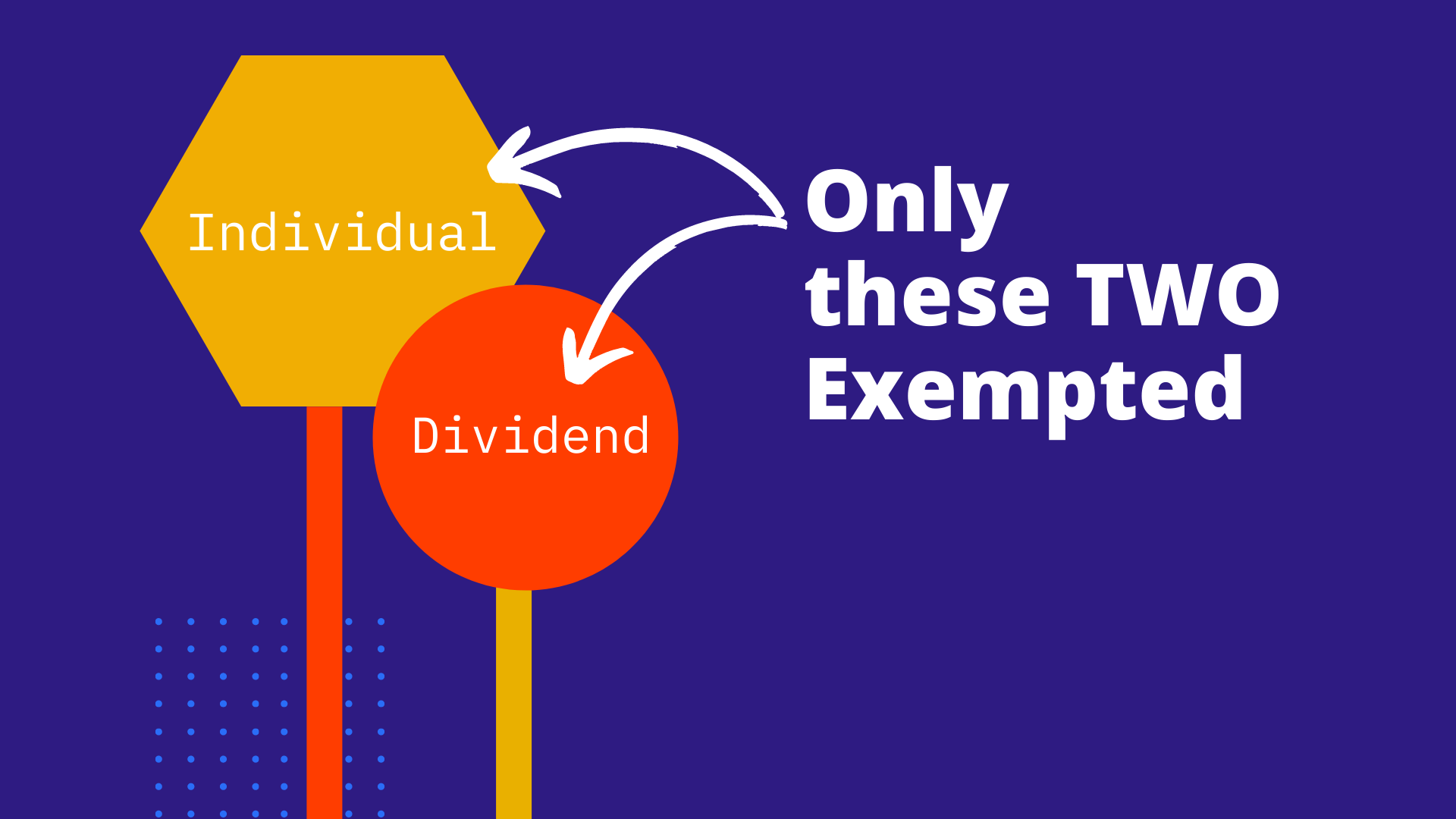

The actual u-turn is only concerning individual and dividend income .

The Government has agreed to exempt all types of Foreign-Sourced Income for individuals who are tax residents in Malaysia except those carrying on partnership businesses in Malaysia.

Companies and Limited Liability Partnerships tax residents in Malaysia will be exempted only on foreign-sourced Dividend Income .

These will be effective from 1 January, 2022 until 31 December, 2026.

It is NOT automatic, free for all exemption . It does come with CONDITIONS , which IRB will publish later.

The NOT U-TURN part

All other Taxable Persons such as trade associations, trust, estate-related executors and administrators, cooperatives, societies, clubs, etc will still be subject to Tax in Malaysia when the foreign-sourced income is received in Malaysia.

Other than Dividend Income received by Company and Limited Liability Partnerships, all other type of Foreign-Sourced Income are still be Taxed.

[One big catch on Dividend Income. For Dividend Income that does not satisfy the exemption criteria will still be Taxable. ]

Taxation of Foreign-Sourced Income has NOT disappeared.

Other than resident individuals and companies and limited liability partnerships receiving dividends, ALL others are STILL subject to Taxation when they receive other types of income. This includes Rental Income , Interest Income , Trust Income , Shares of Partnership Income, Joint Venture Income, Branch Profits, etc. will be subject to Foreign-Sourced Income Tax.

Also, the Amnesty Program for Foreign-Sourced Income still remains intact.

‘When you want to know about Tax, talk to Tax Experts, NOT the newspaper per se, Auditors or the Financial Analysis.”

The Tax Expert’s opinion

Frankly, having talked to Dr Choong and reading few write up this week by other leading tax expert their opinion is similar. Here’s the summary:

Despite this announcement to exempt Foreign-Sourced Income received by individuals, they strongly advise that :

“Individuals keep good records of their Investments and income abroad to differentiate between Capital and Income. ”

Who knows if there is a policy change again in the future? We will not be caught if you had remitted capital instead of income back to Malaysia.

Also, since it is an exemption, it is up to the individual whether to choose:

- The exemption or

- Go for the amnesty program.

You can still opt-in for the amnesty program. The exemption is not all sweet and rosy, in fact.

Foreign Sourced Income is here to stay

Foreign Sourced Income is here to stay. The exemption is welcomed but not suitable for all individuals. It has to be considered with really great care.

Similar to the direction of the wind and sudden rain, there is uncertainty in the political wind. It may swing in any direction. Kita Jaga Kita .

The exemption has been around for more than 24 years

It is something we take for granted.

The tax concept for Foreign-Sourced Income is very different from Conventional Income Tax. We need to know clearly how it works, what is the level of Documentation and Proof required. The amnesty available, Weight the Exemption with Conditions vs the Amnesty needs to be understood clearly.

A press release by MOF can cause so much misunderstanding. It shows how much we don’t understand about Foreign-Sourced Income (frankly I was confused that’s why I did all this research and ask so many tax pro).

At this juncture, there are 6 Questions to ask ourselves:

- What is the difference between foreign-sourced and conventional income tax?

- Why so many people keep on talking about income and capital ? What is the Documentation required to prove either capital or income for Foreign-Sourced Income;

- The Actual Impact of the NEWLY revised updates by Ministry of Finance on 30.12.2021;

- Which are the factors to consider to weigh between choosing Amnesty or the Exemption ;

- For Company’: What is the New Structure to receive the overseas Dividend in Malaysia;

- Partnership: Should we convert partnership to LLP to ride on Dividend Income exemption.

If you are uncertain about the above 6 questions, do attend the foreign sourced income seminar by Dr Choong on 20 January 2022.

Tax can never a guess work.

Restore clarity, have certainty and move with confidence.

“All other taxable persons…..tax in Malaysia when the foreign-sourced income is received in Malaysia. .”