Further to our email sent about a month ago summarising 8 key Company Law concepts which are now obsolete (click here to read Part I, if you miss out on that).

This week we look into the changes affecting heart and soul of the company, ie. THE DIRECTORS (4 Key Changes).

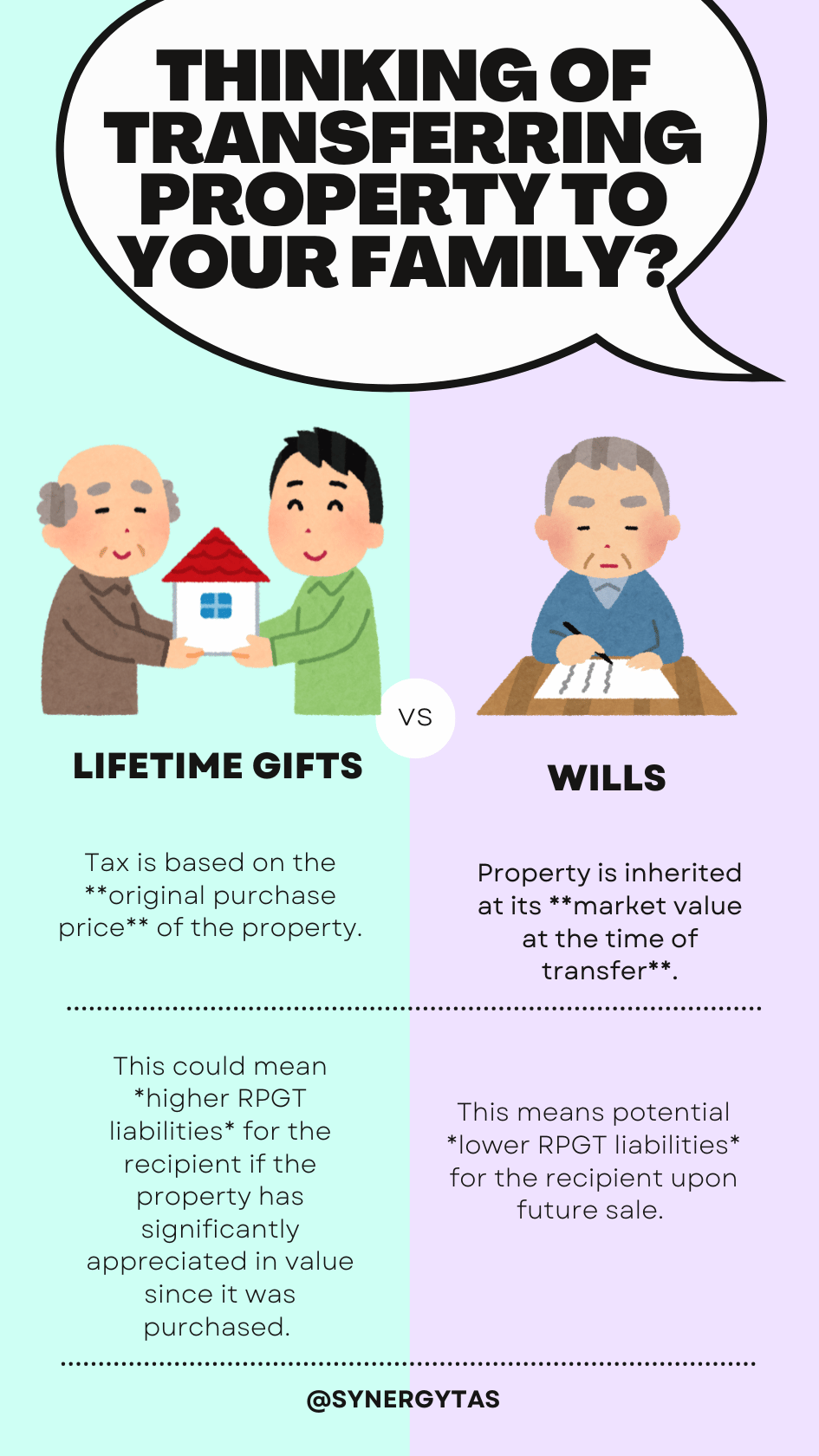

- CHANGE 9 : Director’s Remuneration must be approved by Shareholder

- CHANGE 10 : Protect from being a “Shadow Director”

- CHANGE 11 : Director can get Protection from legal proceedings

- CHANGE 12 : Business Review Section

[UPDATE: The Bill has received Royal Assent on 31 August 2016 and has been gazetted on 15 September 2016 as the Companies Act 2016.]

CHANGE 9 : Director’s Remuneration must be approved by Shareholder

Existing : The CA 1965 is silent on the approval of a director’s remuneration. At Common Law however, directors have no authority to approve their own remuneration as this would amount to a conflict of interest. It is the shareholders who have the authority to approve director’s Remuneration.

NEW : Under the Companies Bill 2015, the remuneration of directors of public companies and any benefits payable (including loss of employment) shall be approved by the shareholders at general meeting.

CB 2015 also prescribes that the service contract of a director of a public company should be made available for inspection at the company’s registered office. These provisions promote greater transparency and accountability of directors.

Whereas the remuneration of directors of private companies may be approved by the board of directors. Shareholders holding at least 10% of the voting rights of the company may however request that a director’s remuneration be subject to shareholders’ approval if they view the remuneration determined by the board of directors as being unfair.

Source : S 230 of CB 2015

| The procedures are administrative in nature, it is essential that you are aware and be in compliance. In view that non-compliance with the prescribed approval procedures stated in s 230, upon conviction will attract a heavy penalty of up to RM 3,000,000 for public company, RM 250,000 for private company. Unless and until an approval has been obtained, any payment received by the director will be deemed as a debt due by the director to the Company. |

CHANGE 10 : Protect from being a “Shadow Director”

Existing : Section 4(1) of the CA 1965 defines a director to include ‘any person occupying the position of director of a corporation by whatever name called and includes a person in accordance with whose directions or instructions the directors of a corporation are accustomed to act and an alternate or substitute director’.

The existing definition is arguably wide enough to encompass a ‘shadow director’. However, it makes it practically impossible to hold such persons accountable to the company since it must first be proven that the entire Board is accustomed to act in accordance to the person’s instructions or directions.

NEW : Companies Bill 2015 remedies this deficiency by lowering the benchmark, where a person is to be regarded as a director of a company if ‘the majority of directors of a corporation are accustomed to act in accordance with the person’s instructions and directions’.

This is consistent with public policy that a person who is able to give instructions to the Board on how it should act should also be subject to the same duties and responsibilities as the directors.

By lowering the benchmark, it imposes a risk on shareholders whom are not directors or yet actively dealing with the management of the company and also on professional consultants or advisors who may be dragged into legal proceedings and casted the duty of a director despite never enjoyed the remuneration nor the benefits of an official director.

Source : S 2 of CB 2015

What is the big deal with being a “shadow director” ?

In comparison with other employees, directors are imposed with fiduciary and legislation duty and subject to legislative sanctioned by the existing Companies Act, where they must act in the best interests of the company (even where this may conflict with their own personal interests). Whereas shareholders are generally free to act in their own interests.

A shadow director is treated in many ways as a real director of the company concerned and so will be bound by the same duties and obligations. However, in most cases the shadow director is unaware of his/her need to comply with the laws relating to directors and accordingly takes no protective measure. Furthermore, the shadow director may not be covered by the company’s directors’ and officers’ liability insurance, if any.

The following are some of the consequences for being labelled as a shadow director:

- Personal liability to contribute to the company’s assets should the company becomes insolvent;

- Being disqualified from holding the position of director should the company becomes insolvent;

- Criminal sanctions for breaches of directors’ duties; and

- Personal liability for breaches of directors’ duties.

It is relatively simple to avoid being a shadow director, that is if you are clear as how the line is being drawn and what the ambit of involvements are.

It should be remembered that acting as a shadow director is not an offence in itself (unless the person is an undischarged bankrupt or disqualified from being a director). The existence of a shadow director is itself a risk indicator. It raises the suspicion that the shadow director is attempting to conceal something by managing the company yet is not being listed as one of its directors.

CHANGE 11 : Director can get Protection from legal proceedings

Existing : Section 140 of the CA 1965 voids any contract by which a company exempts or indemnifies any of its officers (including a director) or its auditor in respect of any negligence, default, breach of duty or breach or trust. There is also some ambiguity on whether a company may contribute to premiums payable for Directors’ & Officers’ Insurance taken out for their directors.

NEW : CB 2015 preserves this restriction. A company is however currently permitted to indemnify a director for any costs of defending legal proceedings but only if the director is successful in his defence or is acquitted. The Bill modifies this position and distinguishes between proceedings involving the company and those of involving third parties.

For legal proceedings brought by a third party, the company may indemnify its directors against any liability and costs of such proceedings whilst proceedings are ongoing. This is crucial as litigation in Malaysia tends be a lengthy and costly process.

Under the Bill, a company may with prior approval of its Board, purchase insurance for its directors against any liability and costs incurred by the person in his capacity as a director.

S 289 of CB 2015

Note: It is however unclear from the CB 2015 if the company can purchase insurance on behalf of its directors only in respect of claims involving a third party (or if this includes claims brought by the company itself), though it is likely the former.

In view of the increase in penalty and range of director’s duties, it is important for directors to request for insurance to be purchased on their own or as part of their remuneration package to mitigate risks and liabilities.

CHANGE 12 : Business Review Section

Existing : Currently, directors of a company are required to prepare an Annual Directors’ Report regarding the affairs of the company.

NEW : Under Companies Bill 2015, in addition to the existing duty to prepare Annual Director’s Report, the Bill further enhanced the report where the director may also include a Business Review Section as set out in Part II of the Fifth Schedule and other reporting requirements as may be prescribed by the regulating body from time to time.

| Note: Part II of 5th Schedule states “may”, hence it is interpreted as optional. Authority may make it compulsory in the near future, do look up for any updates. |

The Business Review Section may include information relating to the principal risks and uncertainties facing the company, the performance and position of the company’s business during and at the end of the financial year, key performance indicators.

In line with the international move and emphasis on corporate sustainability, the business review can also include information on the company’s policies on environmental matters, employees and social and community issues.

Despite the business review section is expressed as optional and at the discretion of the directors to add or omit from the director’s report, CB 2015 nevertheless stated that should the recommended business review section be omitted, the area of the suggested business review section omitted has to be explicitly stated in the director’s report.

S 253 of CB 2015, Part II of 5th Schedule

| New to Company Law ? If you are a director and find it difficult to understand what is stated above, do not worry, just get more background understanding about the company law. SSM did prepare a 12 pages ebook which provide good understanding on director’s duties and responsibilities based on Companies Act 1965. Click here to download that ebook. |

The above summary is created by referencing to Companies Bill 2015, Company Act 1965, CLRC report also on write up prepared by Wong & Partner, Skrine, and MIA.

We are excited by the changes, and glad that there are so many tax gaps and GST planning opportunities arising from it.