Gone are the days speculating on GST Bill 2014.

Monday evening 7.4.2014, the speculation has finally come to an end.

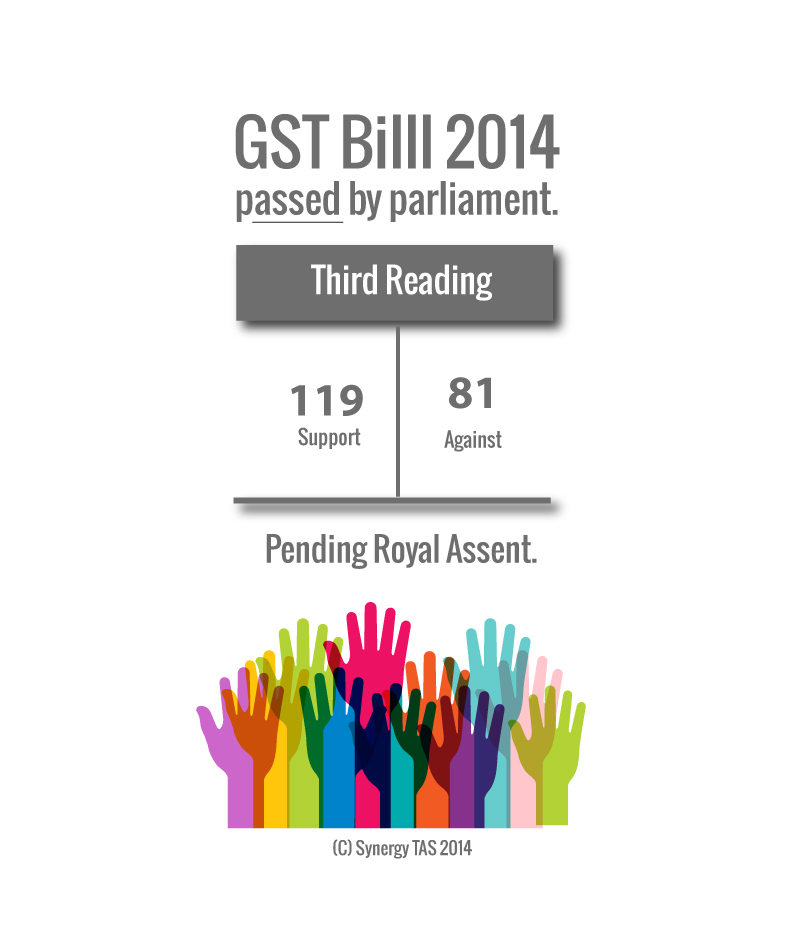

Parliament has passed the Third Reading (Final reading) Goods and Services Bill 2014, with the majority of 119 against 81.

Upon the Royal Assent by Yang di-Pertuan Agong, Goods and Services Act 2014 will be effective.

[title size=”2″]It is coming for real. Are you ready for it?[/title]

[one_half last=”no” text_align=”text-align-left”][title size=”1″]Click the button to download the infographic[/title][/one_half]

[one_half last=”yes” text_align=”text-align-left”][button link=”https://powerfulmanager.com/wp/download-inforgraphic-on-history-of-gst-and-which-level-of-understanding-are-you-at/” target=”_blank” shape=”rounded” size=”medium” outline=”no” color=”black”]Get the infographic[/button][/one_half]

Beyond the “what is” GST phase

Some of you have started preparing since year 2009, some of you have just completed the 10 days Royal Malaysian Customs (RMC) and still waiting for your result to be released (using GST Bill 2009).

Knowing the “what is” phase allows you to pass the GST exam and to be a licensed GST consultant.

But in order to ease GST Implementation, be over and above the licensed GST consultant, you will have to know more than that. Can you imagine the amount of hiccups if you are not familiar with GST implementation? Stressed up during your implementation, auditing and financial report.

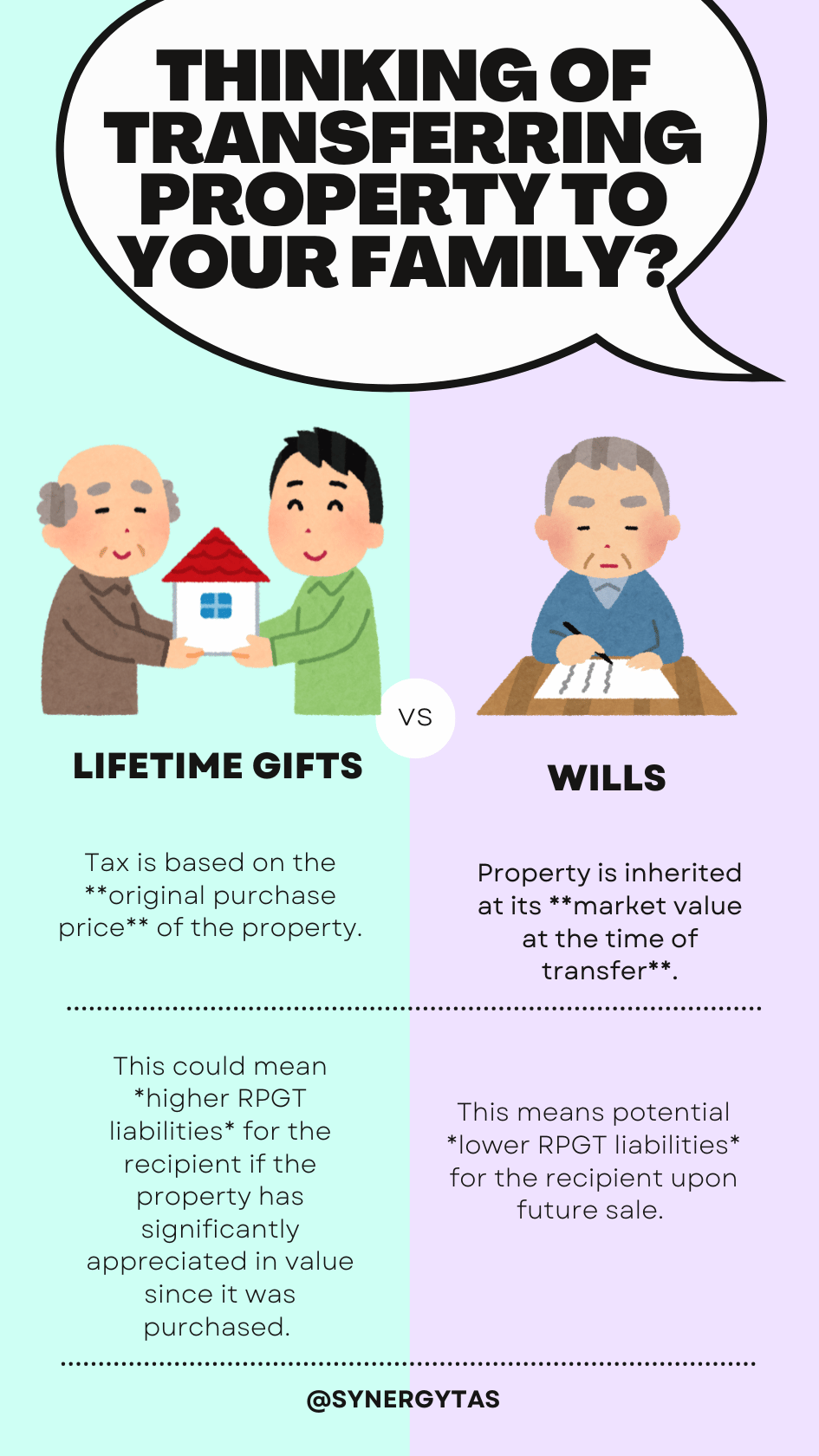

Do keep in mind that GST is a tool to combat Income Tax evasion. Knowing the implementation is complex enough, you must not forget also GST linkage to Income Tax and RPGT.

RMC and Inland Revenue Board (IRB) are both Governing Bodies of Government of Malaysia, and we as citizens of Malaysians are accounted for whatever taxes that are being imposed. Therefore, you must help yourself to account for the right tax.

Our Upcoming Events :

Click on the image below to find out more.