Online Video Learning

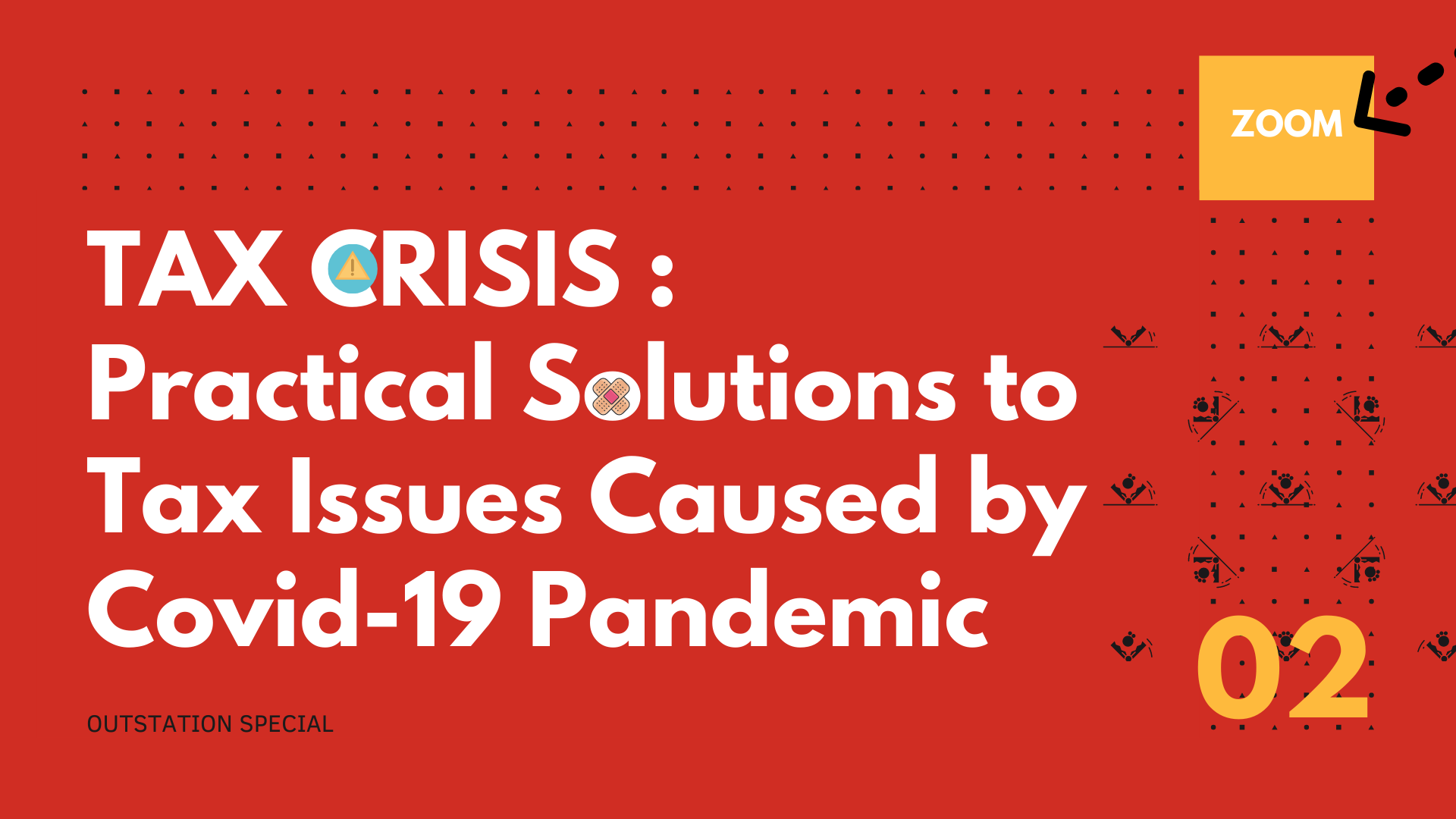

Tax Crisis

Practical Solutions to Tax Issues Caused By Tax Issues Caused By Covid-19 Pandemic

Quick Facts

Duration

7 Days Unlimited Access

Delivered Via

Remote Online Learning

We bring you Unlimited 7 Days Access to Compact 7 Hours Special Annual Malaysia Tax Crisis Seminar featuring Dr Choong Kwai Fatt as the Speaker.

7 CPD 450 Minutes

Learn at the comfort of your own time and space, anytime within the 7 Days. Now you have the ability to pause and rewind to areas of high concern to you.

Tax crisis : contentious tax issue your need to know immediately

The Covid-19 Pandemic has revolutionised the entire Business Regime, completely turning the Domestic and Global Economy into an unknown Frontier. This unprecedented Covid-19 has caused businesses to transform; employees must upskill with New Skill to face the challenges in this ‘New Norm’.

Prompt Action and Wise Decision is urgently Needed!

Prompt Action and Wise Decision is urgently called for to maintain Business Sustenance, Businesses need to do things differently to lead Business Growth. With the support of the re-skill Employees, Businesses would confidently be able to quantum leap to a new level of a business frontier on Wealth Accumulation, comfort and pleasure.

You don't just know the current tax issues, you get practical solution at your fingertips. Ignorance is never a bliss when it comes to tax.

This “NEW Normal” cause a lots more tax issues than Most Accountant Imagined

Dynamic contentious Tax Issues are complicated in every aspect and dimension. With guidance from a seasoned and experienced tax consultant, one would be then able to completely comprehend in resolving these Tax Issues with pragmatic Business Solutions.

Analyses the various unique Tax Issues

This ONE DAY LIVE Zoom session is first of its kind by Dr. Choong Kwai Fatt. It primarily analyses the various unique Tax Issues that arise during this pandemic era. Companies can quickly take advantage of the various Tax Incentives provided by the Government. Also, in implementing the much-needed Tax Measurement to achieve every Tax Efficiency, which will lead to Business Sustainability, if not more Growth.

2 Hours of Q & A for your

Special two hours allocated to address the various Questions sent in by the participants five days before the Live Zoom event.

TIME TO CHANGE YOUR BUSINESS STRATEGIES.

Strategies need to change with changing circumstances. Tax need to follow facts ! You need to know the CURRENT CONTENTIOUS ISSUES and UTILISE MOST UP-TO-DATE TAX PLANNING OPPORTUNITIES .

SO MANY RARE TAX PLANNING OPPORTUNITIES! This is not conventional Tax Seminar. Be safe by knowing how to correctly apply latest change in tax rules. ALSO have in hand Latest Exciting Tax Planning you want to grab immediately!

Hot Tax Planning Topics

- Waiver of Debts

- Compensation from Termination, short notice and Distributor Agreement

- Stock in trade

- Retrenchment of Employees

- Contra Debts for Settlement

- Distribution of Real Property in lieu Payment

- Inter-company Loan

- Director Loan to Company

- Company Advances to Director

- Cessation of Business - Temporary or Permanently

- Bad Debts Recovery

- Management Fees

- Deposit for Services s24(1A)

- PENJANA Tax Incentives

Join this seminar.

Grab the Solutions to Tax Crisis Arising from COVID 19 Pandemic.

Timeline

Note

Your Speaker, Dr Choong Kwai Fatt, is know for his passion in sharing tax know-how. He is committed to high quality of presentation and insists that all materials are covered and gives as much value as possible. Therefore the schedule may vary. Especially for Q & A session, which is the most highly anticipated.

Part 1

Module 1 -7

- Practical Applications and Implementations of various PENJANA Tax Incentives

- Waiver of Debts

- Analysis

- Building up on Capital Receipts

- Compensation Receipt on

- Termination of Contract

- Distribution Agreement

- Short notice of Resignation on Key Employees

- Stock in trade

- Valuation Mechanism

- Write off stock Procedures

- Write down Stock Compliance

- Retrenchment of Employees

- With re-employment

- New Employment

- Tax Incentive and Tax Exemption

- Contra Debts for Settlement

- What are its Mechanism and Procedures?

- Market Values Issues

- Distribution of Real Property in lieu

- Payment of Gratuity

- Compensation for Loss of Employment

- Accrued Salary

Module 2 - Questions and Answers

Answers to Many of the Q & A Submitted by various Participants during Zoom seminar.

Part 2

Module 8 -14

- Inter-company Loan Transactions (Related parties)

- Deduction of Interest Expense

- Assessment of Interest Income

- Significance and Applications on ‘due to be paid’

- Director Loan to Company

- Transfer Pricing Adjustment

- Interest free or with Interest

- Deeming Interest Income Application

- Company Advances to Director

- With Shareholding (> 20%)

- With Shareholding (≤ 20%)

- Paper Loan, Fake Loan

- Real Loan

- Deemed Interest Income Application s140B

- Cessation of Business

- Temporary

- Permanently

- What are its Implications and Complications?

- Bad Debts Recovery

- Management Fees

- Deduction Criteria

- Income Assessment

- Deposit for Services s24(1A)

Part 4 - Questions and Answers

Answers to Questions submitted by Live Zoom's Participants can ask any questions not limited to the topics of discussion

…. More content will be added as changes from Budget

2021, Gazette Orders and Guidelines issued prior to event date.

Join this seminar.

Grab the Solutions to Tax Crisis Arising from COVID 19 Pandemic.

Who is this for?

Created for Business Owners, Accountants, Financial Personnel, Company Directors and you of course.

(Personnel involved in Managing the Company)

Shareholders and Directors are exposed to Personal Risk of Travel Restriction, Personal Liability to pay for “Tax Undercharged” and Company Bankruptcy. Therefore Shareholders and Directors must have personal understanding of what are the latest risks they are facing and ensure the right safeguard is in place. Especially to take advantage of available Tax Incentives, Business Recovery, Corporate Restructuring ideas and Tax Planning Opportunities. (Applicable to all industry)

(CEO, CFO, General Manager and Financial Controller)

Opportunities goes to those who are ready. During this Covid 19, there are so many opportunities available for tax planning. At the same time there are a long list of pricy tax trap which will cost company huge amount of money. To ensure the company continue to prosper and remain relevant, be ready for these Tax Crisis and get to know what are the major hiccups in tax which impact Businesses Decisions Making. Where Economy, Taxation and Business Direction need to be known. The Decision Makers must be well advised and comprehend the significance and be able to plant the right seeds and direction for the company.

The Advisors need to gear up and patch up your dose of Know-How from this NEW TAX CRISIS. There are so many change in mindset and approach arising from COVID 19. Get the Latest KNOW HOW and New Action Plan needed.

Applying a MFRS and SST are tough enough, plus Companies Act changes which is bringing Malaysian Business Structure change and cut across all industries in your accounting work. NOW there is another wave of change in New Government Business Direction with the regards of Covid-19 that you MUST BE READY FOR.

How will it affect your Business Direction, Accounting Entries, Documentation from now onwards and all the compliance requirements and thresholds involved. There are ample work to PATCH UP on the missing UPDATES.

Join this seminar.

Grab the Solutions to Tax Crisis Arising from COVID 19 Pandemic.

Dr Choong Kwai Fatt

Dr Choong Kwai Fatt is an acknowledged tax authority and a leading tax specialist in Malaysia, highly sought after speaker and provided tax consultancy services to listed companies, audit firms, legal firms and the Malaysian Government for more than 25 years.

Like a diamond with multiple façade, Dr Choong shines for his depth of tax knowledge, rare combination of skill and experience derived from being a speaker, writer, researcher, advocate and solicitor, consultant and his passion towards tax education.

Collectively this has resulted in his outstanding presentation skill and charming persona as a speaker and advisor.

Join this seminar.

Grab the Solutions to Tax Crisis Arising from COVID 19 Pandemic.

How will the course be conducted?

Online Video Learning

An Important Online Video Course by Dr Choong Kwai Fatt

We will deliver the seminar via our online Learning Management System on our Unique Online Learning website. We will send you :

- Access Code and the details for your to sign in.

- You will be given 7 Days Access upon the date you sign in;

- The pdf version of the course material are all accessible and downloadable from the website.

- You will be given access of 3 month to post 10 tax questions to Dr Choong.

7 Days Access

You will be given the sign in details and instruction via email. The video learning is accessible anytime for 7 days.

10 Questions, Answered by Dr Choong

Get direct access to Dr Choong. Be it question on implementation, technical question or clarification on any of the content in the course.

Seminar Materials

You will be given the sign in details and instruction via email

Join this seminar.

Grab the Solutions to Tax Crisis Arising from COVID 19 Pandemic.

Pricing

Choose the right category based on the number of participants.

7 Days Access

Watch anywhere, anytime, as many times as you want!

8 Learning Modules, 500+ Minutes of Video Content

Everything you need to know to start tax planning for 2021.

10 Questions (Answered by Dr Choong)

Get personal advice from Dr Choong. Where you can send in 10 questions within 3 months, Dr Choong will send you written answer personally to your inbox.

Playback, Rewind Anytime, Anywhere

Tax planning require clarity and structure. Being a video based learning, you have the freedom to pause, rewind and replay the part of the video you are interested in.

Downloadable Course Notes

Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

HRDF Claimable

You can claim up to RM 600 from HRDF. RM500 for course fee, RM 100 for internet (no bill required).

Join this seminar.

Grab the Solutions to Tax Crisis Arising from COVID 19 Pandemic.

Need a copy of the

Join this seminar.

Grab the Solutions to Tax Crisis Arising from COVID 19 Pandemic.

FAQ

Most frequent questions we received.

No. The CPD stated on the Certificate of Attendance is as awarded by the Training Provider in recognition of the hours spent learning with the respective Speaker/ Trainer.

Unfortunately, it is subject to the discretion of the respective institution whether or not to accept the point or otherwise.

Yes, we do understand plans are always subject to change. Do provide us the name 10 Days prior to the event date. If change of name were to notify after we have printed the Certificate of Attendance, reprinting of cert can be done with a Certificate Reprinting Administrative Fees of RM 100.

No. We wish we can answer yes to this. Our Seminar is based on latest and most up to date information, rules and regulations, with a cut off point of 1 to 2 weeks before the event. The earliest date for us to get the seminar materials from the Trainer/ Speaker is 1 – 2 days prior to event date. In this regards, we will have to turn down all request to deliver materials prior to event date.

Unfortunately, most of the sessions will not be repeated. Should there be a similar session, you can change to other session of the same event, subject to availability.

Refund is not possible as all seating arrangement with venue and printing of materials have been arranged and put in place. However, we can accept replacement by informing us via email 10 days prior to the event.

Yes. This seminar does not just cover the surface Updates or Latest Developments, it covers the most crucial question : “How to implement and embed them into my Company System?”

Join Us and Expect to take away How Practical Solutions and Implementation Pointers.

We distinguish ourselves based on three areas. We are specialist in arranging effective and quality seminars.

We are also reputable event organising company set up to organise Advanced Tax Planning event. Our motto is to encourage the policy of “Plan Your Tax, Do NOT Evade Tax.”

Our Participants mainly consist of Corporate Leaders, Practitioners and Senior Executives, we hold firm to the view that we must do all it takes to maximise learning and impact in a minimum amount of time. We take pride in providing the most updated and well researched information.

Yes, we are HRDF Approved Training Provider. Our Live events are HRDF Claimable*

(*Subject to PSMB’s approvals by Participants). However do note that HRDF has new guideline on the claiming of HRDF on online training. Where there is restriction of RM 500 per day (with minimum of 4 hours training conducted over 2 days).

This applies to Company that is contributing to HRDF Fund.

Usually for live training as per the information we gather from Participants over the years, register and get the Invoice first.

Then, together with the Brochure, submit both Invoice and Brochure to HRDF for pre-approval (usually takes about 3 to 5 working days).

Once pre-approved, please proceed to make payment to Synergy TAS PLT.

Company can claim back the money from PSMB after participants attended the event by submitting both the Certificate of Attendance and Official Receipt from us.

For Online training, HRDF do impose additional criteria. Such as the minimum number of hours and the minimum number of days and maximum number of participants per session. Do check with HRDF for more information on this.

If you have the latest updates as to how to claim HRDF, please do share with us via event@synergytas.com.

Thank you for sharing!