Online Learning | HRDF Claimable

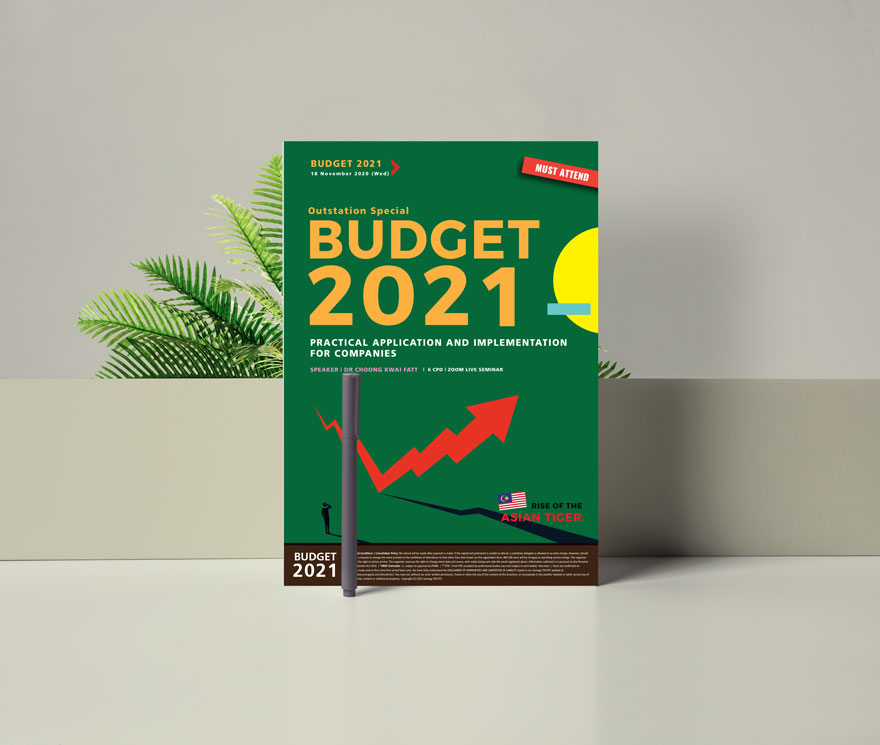

BUDGET 2021

Practical Application Implementation for Businesses & Employees

Quick Facts

Duration

7 Days Unlimited Access

Delivered Via

Remote Online Learning

We bring you Unlimited 7 Days Access to Compact 7 Hours Special Annual Malaysia Budget 2021 Tax Planning Seminar featuring Dr Choong Kwai Fatt as the Speaker.

7 CPD 450 Minutes

Learn at the comfort of your own time and space, anytime within the 7 Days. Now you have the ability to pause and rewind to areas of high concern to you.

With the rise in COVID 19, this Zoom session is created especially for you.

Business & EMPLOYEE Tax PlanninG FrOM Budget 2021 : your Important company's annual tax updates

Malaysia’s Largest Budget Expenditure has been approved by Parliament!

Malaysia Shifts to Macroeconomic Approach : Similar to China Unlike past Budget this Budget 2021 is shifted to a Macroeconomic Approach. This strategy is not New, but it has shown to work. China GDP up by 4.9% from a year ago, despite slumped in Global Economy. They too use the Strategy of boosting Spending Power. Malaysian Government intentionally creating extra Cashflow for the Rakyat to spend so as to kickstart and CREATE Growth in Economy. And focus on B40 and M40 to boost our local Economy from bottom up.How it Works ?

With the anticipated spending of RM322.5b. RM11.2b is allocated especially to B40 group to spearhead Economic Growth. Increase spending capacity of the B40, as they spend it will stimulate Domestic Consumption. With Government pumping billions into our Economy. This money will flood all sectors in Malaysia.Comprehensively Update Company's Latest Tax Rules

Without Reading a Line of the Act !

There are long and lengthy tax changes happening each year. This year is extraordinarily special.

This Budget 2021 is created to boost the economy. There are so many company and employee tax changes for your to grab.

Practically Update and be ready for your 2020 and 2021 tax filing without reading a line of the source documents. Ride on the rise in tax economy with legally minimised taxes.

Other than compliance update, there are so many tax planning waiting for you, they are part of the long list of exciting changes you should look out for in this Budget 2021 Online Course!

Ignorance is a very pricy and painful mistake businesses will not want to risk.

TIME TO UPDATE IMMEDIATELY.

Tax need to follow facts ! It is time to UTILISE MOST UP-TO-DATE TAX PLANNING OPPORTUNITIES FROM THIS ANNUAL MALAYSIA BUDGET 2021.

Employee will be the Big Winner, if….

Budget 2021 needs to help Companies to retain Employees. When study closely you will notice Finance Bill has created a lots of Tax Planning Opportunities especially for Employee Tax Planning. Company can easily slash Tax heavily for Employee by adjusting Employee’s Package to be inline with Tax Planning Strategy, and immediately Generate extra Cash [ie. spending power for the M40 (which made up of majority employees)].

Dr Choong is confident that the Malaysian Economy would be able to achieve Growth, beginning 2021. The mantra of Success and Survival would be ‘Do things Differently’ and ‘Do Different Things’.

Incentive and Encourage New Ways of Doing Business

As the saying goes “Opportunity goes to those who are Ready.” How ready are You?

Spearhead businesses have always been the objective of Fiscal Policy for any Country. This Budget 2021, Government focuses on boosting New Ways of doing Businesses, and provides many Incentives and Grants to benefits Businesses while Businesses harvest Profit from the cycle of B40 and M40’s continuous spending.

Tax Audit and Investigation will be Up in 2021

Especially with Transfer Pricing coming into effect on 1 January 2021. No wonder our Finance Minister is confident to announce the increase of budgeted Tax Collection will increase from RM 127b to RM143.9 billion in 2021. As the Objective is to combat Shadow Economy, and it needs to be achieved via highly active Tax Audit and Investigation. The cat is coming, are mice prepared?

Budget 2021 Zoom Seminar : Business & Employee Tax Planning

Covid-19 has brought a lot of dreadful changes in our life, contrarily it has created lots of Opportunities on the other side. These special Tax Planning via Zoom Sessions with Dr. Choong Kwai Fatt will place in your hand these Business and Employee Tax Planning on Budget 2021. Be benefited from this RM322.5b Budget allocation, at the comfort of your home or office via live zoom session with Dr Choong.

Completely Transform, Reform the existing Business Structure, Reformulate Employees’ Packages, Adopt the many Tax Strategies and utilize the Tax Incentives for every Tax Efficiency in Business.

Special Q & A Session

The theme of this Outstation Special Budget 2021 Seminar is “Practical Application” for Companies . The Special Q & A sessions are the highlights for this special online course. Where the questions submitted by the industry players anonymously were answered by Dr Choong special Budget 2021 online course.

Participants love these sessions since they can learn from each other’s concerns, pre-empt potential challenges and gain a practical solution to frustrating implementation hiccups.

The excitement doesn’t just stop there, to make things even more practical. Participants can send in 6 questions pre-seminar and 6 questions after the seminar where your Tax Concerns replied with pragmatic solutions by Dr Choong personally.

We are eager and look forward to seeing you in this Online Course. Stay safe and healthy!

Hot Tax Planning Topics

Here's some of the content ...

Part A :

Tax Planning for companies – SMEs and non SMEs

- Attractive tax rebate RM20,000 for 3 YAs – implementation and application

- Restructuring for survival – ‘how to’ approach

- Investment holding company – dilemma & how to overcome on gross business income ≤ RM50 million

- Renovation and Refurbishment incentive – maximization approach

- Withholding Tax Compliance – the know how and fatal trap

- Plant and machinery – the new tax strategies

Part B :

Tax incentives – implications and complications

- ACA on machinery and equipment – how to utilize and what is exclusion

- New Plant definition again (the new para 70A, Sch 3) – scope and application

- Maximise Employees’ Remuneration – how to maximize deduction

- Industry4wrd readiness assessment – practical deduction application

- Relocation Incentives – exemption, 10%, 0% (choosing criteria)

- Private healthcare incentives

- Industrialised building system – investment tax allowance application

- Know the Resource and Non Resource based incentive

-

Research and development

– double or single deduction

– the demarcation rules - Reinvestment allowance – expansion and utilization

Part C :

Tax strategies for commercial efficiencies

- LLP, SME – selection and utilization

-

Legal expense

– maximize deduction

- ‘how to’ approach - Trade debtors – deduction and prohibition

- Disposing plant and machinery – now or never

- Gazette Order updates

Part D :

Timely Company Structuring and Restructuring

- Disposal of business – noting points

- Acquisition of business – how to integration as one business

- Business acquisition or company acquisition

- Merger of business – fatal points, alert notes

- Anti avoidance application and defence

Part E :

Tax planning for employees and key employees

- Understand new tax relief

- Maximizing existing relief

- Restructure existing employment package

- Outsource or multiple sources

- Upskill with new skills or reskill

- Cessation of employment – the consideration approach

- Gratuity or compensation for loss of employment – the core essential factor for selection

- Unique Aged uncle tax planning

- Women entrepreneurs – incentives and applications

- Angel investor with equity crowdfunding

Part F :

Sales tax exemption and facilities

- Changes and developments in 2020

- Practical applications of exemption and facilities

Part G :

Service tax applications and difficulties

- Changes and developments in 2020

- Imported taxable services – scope and application

- Digital service tax – exemption and application

- Services provided within group

- B2B exemption

- Reimbursement is now taxable service

- Service tax entangle with withholding tax – the sorting out rule

Join this Online Course Now.

Grab these rare Malaysia Budget 2021 Tax Planning Opportunities.

Participant’s reviews

What people say?

Timeline

The estimated timeline

Note

Your Speaker, Dr Choong Kwai Fatt, is know for his passion in sharing tax know-how. He is committed to high quality of presentation and insists that all materials are covered and gives as much value as possible. Therefore the schedule may vary.

MODULE 1

Tax Planning for Companies – SME and non-SME

MODULE 2

Tax Incentives – Its Implications and Applications

MODULE 3

Tax Strategies for Commercial Efficiencies

MODULE 4

- Timely Company Structuring and Restructuring

MODULE 5

- Tax Planning for Employees and Key

Employees

MODULE 6

- Sales Tax Exemption and Facilities

MODULE 7

- Service Tax Applications and Difficulties

MODULE 8

- Q & A

Join this Online Course Now.

Grab these rare Malaysia Budget 2021 Tax Planning Opportunities.

How will the course be conducted?

Online Video Learning

An Important Online Video Course by Dr Choong Kwai Fatt

We will deliver the seminar via our online Learning Management System on our Unique Online Learning website. We will send you :

- Access Code and the details for your to sign in.

- You will be given 7 Days Access upon the date you sign in;

- The pdf version of the course material are all accessible and downloadable from the website.

- You will be given access of 3 month to post 10 tax questions to Dr Choong.

7 Days Access

You will be given the sign in details and instruction via email. The video learning is accessible anytime for 7 days.

10 Questions, Answered by Dr Choong

Get direct access to Dr Choong. Be it question on implementation, technical question or clarification on any of the content in the course.

Seminar Materials

You will be given the sign in details and instruction via email

Pricing

How much to invest to acquire these new hot skills ?

7 Days Access

Watch anywhere, anytime, as many times as you want!

8 Learning Modules, 500+ Minutes of Video Content

Everything you need to know to start tax planning for 2021.

10 Questions (Answered by Dr Choong)

Get personal advice from Dr Choong. Where you can send in 10 questions within 3 months, Dr Choong will send you written answer personally to your inbox.

Playback, Rewind Anytime, Anywhere

Tax planning require clarity and structure. Being a video based learning, you have the freedom to pause, rewind and replay the part of the video you are interested in.

Downloadable Course Notes

Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

HRDF Claimable

You can claim up to RM 700 from HRDF.

Join this Online Course Now.

Grab these rare Malaysia Budget 2021 Tax Planning Opportunities.

Who is this for?

Created for Business Owners, Accountants, Financial Personnel, Company Directors and You of course.

(Personnel involved in Managing the Company)

Shareholders and Directors are exposed to Personal Risk of Travel Restriction, Personal Liability to pay for “Tax Undercharged” and Company Bankruptcy. Therefore Shareholders and Directors must have personal understanding of what are the latest risks they are facing and ensure the right safeguard is in place. Especially to take advantage of available Tax Incentives, Business Recovery, Corporate Restructuring ideas and Tax Planning Opportunities. (Applicable to all industry)

The Advisors need to gear up and patch up your dose of Know-How from this Annual Malaysia Budget 2021 Seminar in view of this ongoing Covid-19 pandemic that is happening locally as well as internationally.

Get the Latest Malaysia Budget 2021 Approach implemented by ruling Government, latest KNOW HOW and New Action Plan needed.

Applying a MFRS and SST are tough enough, plus Companies Act changes which is bringing Malaysian Business Structure change and cut across all industries in your accounting work. NOW there is another wave of change in New Government Business Direction with the regards of Covid-19 that you MUST BE READY FOR.

How will it affect your Business Direction, Accounting Entries, Documentation from now onwards and all the compliance requirements and thresholds involved. There are ample work to PATCH UP on the missing UPDATES.

Quick Facts

our Tax Planning Participants are Senior Management and Key Decision Makers.

Here's 2 reason why :

Reason One

Tax Planning is a rare gem. Experienced Senior Management appreciate the fact that the more they legally slash from Tax, the more Profit they can easily retain in the company. The extra cashflow provides substantial competitive advantage to the company.

Reason Two

Risk Management is on the shoulder of Senior Management (especially Directors), compliance and right documentation free them from lots of Tax Headache and be confident when they faced with Tax Audit and Investigation.

[One Last Secret: We notice most of our frequent attendees get promoted Very Fast in their respective Company. I suppose, those who can create high impact on company's $$$ will tend to get priority to be headhunted for promotion when it is available.]

Join this Online Course Now.

Grab these rare Malaysia Budget 2021 Tax Planning Opportunities.

Dr Choong Kwai Fatt

Dr Choong Kwai Fatt is an acknowledged tax authority and a leading tax specialist in Malaysia, highly sought after speaker and provided tax consultancy services to listed companies, audit firms, legal firms and the Malaysian Government for more than 25 years.

Like a diamond with multiple façade, Dr Choong shines for his depth of tax knowledge, rare combination of skill and experience derived from being a speaker, writer, researcher, advocate and solicitor, consultant and his passion towards tax education.

Collectively this has resulted in his outstanding presentation skill and charming persona as a speaker and advisor.

Join this Online Course Now.

Grab these rare Malaysia Budget 2021 Tax Planning Opportunities.

FAQ

Most frequent questions we received.

No. The CPD stated on the Certificate of Attendance is as awarded by the Training Provider in recognition of the hours spent learning with the respective Speaker/ Trainer.

Unfortunately, it is subject to the discretion of the respective institution whether or not to accept the point or otherwise.

Yes, we do understand plans are always subject to change. Do provide us the name 10 Days prior to the event date. If change of name were to notify after we have printed the Certificate of Attendance, reprinting of cert can be done with a Certificate Reprinting Administrative Fees of RM 100.

No. We wish we can answer yes to this. Our Seminar is based on latest and most up to date information, rules and regulations, with a cut off point of 1 to 2 weeks before the event. The earliest date for us to get the seminar materials from the Trainer/ Speaker is 1 – 2 days prior to event date. In this regards, we will have to turn down all request to deliver materials prior to event date.

Unfortunately, most of the sessions will not be repeated. Should there be a similar session, you can change to other session of the same event, subject to availability.

Refund is not possible as all seating arrangement with venue and printing of materials have been arranged and put in place. However, we can accept replacement by informing us via email 10 days prior to the event.

Yes. This seminar does not just cover the surface Updates or Latest Developments, it covers the most crucial question : “How to implement and embed them into my Company System?”

Join Us and Expect to take away How Practical Solutions and Implementation Pointers.

We distinguish ourselves based on three areas. We are specialist in arranging effective and quality seminars.

We are also reputable event organising company set up to organise Advanced Tax Planning event. Our motto is to encourage the policy of “Plan Your Tax, Do NOT Evade Tax.”

Our Participants mainly consist of Corporate Leaders, Practitioners and Senior Executives, we hold firm to the view that we must do all it takes to maximise learning and impact in a minimum amount of time. We take pride in providing the most updated and well researched information.

Yes, our events are HRDF Claimable*

(*Subject to PSMB’s approvals by Participants). However do note that HRDF has new guideline on the claiming of HRDF on online training. Where there is restriction of RM 500 per day (with minimum of 4 hours training conducted over 2 days).

This applies to Company that is contributing to HRDF Fund.

Usually for live training as per the information we gather from Participants over the years, register and get the Invoice first.

Then, together with the Brochure, submit both Invoice and Brochure to HRDF for pre-approval (usually takes about 3 to 5 working days).

Once pre-approved, please proceed to make payment to Synergy TAS PLT.

Company can claim back the money from PSMB after participants attended the event by submitting both the Certificate of Attendance and Official Receipt from us.

For Online training, HRDF do impose additional criteria. Such as the minimum number of hours and the minimum number of days and maximum number of participants per session. Do check with HRDF for more information on this.

If you have the latest updates as to how to claim HRDF, please do share with us via event@synergytas.com.

Thank you for sharing!

Join this Online Course Now.

Grab these rare Malaysia Budget 2021 Tax Planning Opportunities.

Need a copy of the

We provide both. View them online or the download pdf version.