Each Expenditure Needs a Unique Set of "Golden Thread"

SYNERGY TAS

Business Tax Deduction

Identify "How to make it Deductible" and "Evidential Proof"

Needed for Your Tax Filling.

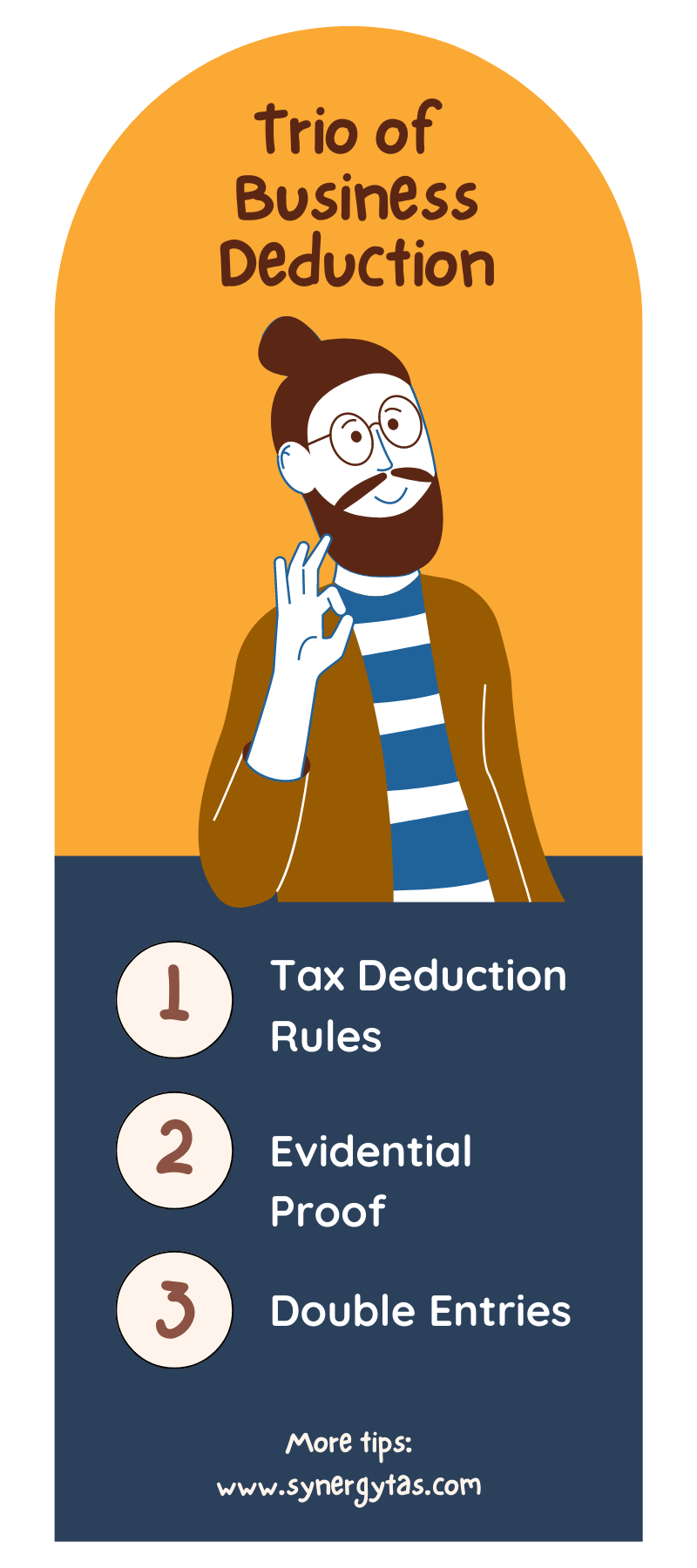

Get all three areas of tax deduction covered :

Tax Deduction Rules,

RIGHT Accounting Entries and

"Golden Thread" Evidence.

THE DEDUCTION TEST

When it comes to Business Deductions, it’s not just about keeping an eye whether it relates to your Income Production activities, but also making sure that your deductions are not just remotely related to your business. Sounds easy, right? Wrong!

HUGE TAX AND PENALTIES

And if you thought that was complicated, just ask companies who’ve lost

their humongous Tax Cases due to some unexpected Bad Accounting Entries and Misrepresented Descriptions. Yikes! Now they’re dealing with additional tax and penalties on incorrect returns.

Moral of the story? Deductions are Serious Business, and the Good News is that Deductions can be learnt. Avoid those errors, and you’ll be on your way to saving Big Bucks and NOT getting hit with unexpected Tax Penalties.

Do you know:

Most Tax Audit failed, because company submitted "Accounting Evidence", instead of "Legal Evidence".

Many Companies unintentionally use the WRONG Accounting Entries or have WEAK Supporting Documents. This causes great disaster when it comes to Income Tax Audit.

After attending this seminar you will master HOW TO SECURE your Tax Deduction with the Trio of TAX DEDUCTION.

It's happening THIS JUNE. So that you can have ALL your TAX CONCERNS settled BEFORE TAX SUBMISSION

Just knowing Tax Deduction RULES is NOT ENOUGH

Tax deduction is not just looking at Tax Deduction Rule. In order to determine whether it is deductible or not, you'll need the RIGHT DOCUMENTS and RIGHT DOUBLE ENTRIES.

Tax Audit is inevitable, we need to move from conventional evidence compiled for Financial Audit Evidence, to keeping "Golden Thread" evidence. (Read on to understand why).

Double Entries is NO LONGER just for accounting purposes. it is now used by Tax Officer to prove intention of the company. Some double entries are "Tax Trouble Magnet".

They will be clearly highlighted so that you "CLEAN" them from your Chart of Account easy-peasy.

Tax Officer Don't Want You to Know This ....

The Experienced Accountant realised there is a knowledge gap, but don't know what's missing.

Payment Voucher and Bank Statement is for your Financial Auditor.

NOT SUFFICIENT for TAX AUDIT.

What we are revealing here is an Insider Know-How that TAX OFFICER will Never want you to know. Let's begin now!

WHY Financial Audit Evidence is not sufficient as Tax Evidence?

In simple words: you cannot use Football when playing Basketball games.

"Financial Audit evidence" is used for internal purposes. It is used to provide reasonable assurance that a company's financial statements are free from Material Misstatement. Where the focus is on "Double Entries" , "Balancing the Accounts" and "Cashflow".

While the "Golden Thread" principle is used in legal proceedings, they don't just look at whether the transaction exist or not. It requires documents which "explains" their link to Tax Deduction Rules.

Tax Officer works on "Golden Thread" Principle

Tax Officers are specifically trained to look for "Golden Thread" Principle. They know it's an easy case when the Accountant just submit a bunch of Receipt and Payment Vouchers.

Example of "Golden Thread" Principle In Action

If you claim a Tax Deduction for a Business Trip, Tax Officer need to see a travel itinerary, a receipt log, and a business purpose statement to support your claim. If you claim a Double Deduction for Research and Development, make sure that you have documentation explaining your research and why you meet the criteria for double deduction, not just submitting a stack of Financial Audit Evidence (ie. receipts, followed by a payment vouchers and third party verification) again and again.

Dr Choong especially creates this BUSINESS TAX DEDUCTION 2023 for participants so that participants know clearly whether that expense fulfill Tax Deduction Rules, and know exactly what documents to have in hand.

Mastering this "Golden Thread" Principle may sound like a tricky and abstract concept, but it's actually a VERY Practical and Useful concept. It provides you the legal mind and sharpness that you need when there is any legal dispute (be it for Contract or Debt Dispute).

By clearly understanding Tax Deduction Rules and observing this Golden Thread that ties your evidence to your tax position, you can avoid surprising "Add-Back", have a strong case, and confident that in your Tax Deduction.

Dr Choong over the years has conducted countless tax training for Accountants, Business Owners and his peers.

He noticed there is ONE BIG CHALLENGE ! The Workscope for "Accounting, Tax and Law" has become increasingly overlapping, yet the skillset has not been integrated properly. There are too many conflicting understandings. That's why this Business Tax Deduction 2023 is created to patch up the gap.

About the Seminar

Date

13 & 14 June 2023 (Tues and Wed)

Speaker

Dr Choong Kwai Fatt

Venue

Sheraton Petaling Jaya

HRDC Claimable

SBL Khas. No.: 10001294483.

What's covered?

EVERYTHING YOU NEED TO KNOW FOR THIS YEAR TAX FILLING.

Dr Choong will cover wide areas of Tax Deduction comprehensively and do send us your areas of concerns (if any). Especially near to tax submission, more issues will surely pop up.

- Understanding the Tax Dynamic between: Asset, Liability and Business Deduction?

- All you need to know about Stock in Trade

- Invoice and Debit Note

- Different treatment on Trade Debtors and other Debtors

- General provisions

- Write off related party trade debtor

- Contra debt with properties

- Specific provision for doubtful debts – procedures for rock solid Tax Deduction

- How to give Advances to related companies?

- Transfer pricing risk consideration

- Conversion of debts to equity

- Interest free or WITH Interest

- Write off advances

- Conversion of debts to equity

- Interest free or WITH Interest

- Provision of Liability and accrual of Expenses

- The demarcation between Provision and Accrual of Expenses

- Warranty Expenses an accrual?

- Gratuity, Retirement Benefit

- Rental Expense as deduction

- Rental and Premium

- Advertisement, Promotion, Marketing Activities, Sponsorship

- Specific Deduction of expenses and Double Deduction: Accounting Rule vs Tax Rule

- Business Model and Structure to use NOW

- Commencement of Business - Demarcation Point

- Business Loss -Noting Points and its effect on Zerorise

- Temporary cessation of business and permanent cessation

- Difference between “Expenses, Allowance, Subsidy, Reimbursement”?

- Staff Remuneration Package

- Keyman Insurance, Life Insurance for Director

- Interest expense on money borrowed

- Expenses related to Withholding Tax

- Loan to Director – Deemed Interest Income or Interest Restriction

- Preference Shares Dividend – Interest Expense Deduction Availability

- Lease Rental on Motor Vehicle, Plant and Machinery

- Repair and Maintenance on Plant and Building

- Intangible Asset

SUITABLE FOR ALL INDUSTRY.

When you attend this seminar. you get the complete coverage of all THREE Component (Tax rules, Double Entries and Evidence).

Need clarification feel free to contact me. The seats are limited do sign up ASAP.