This 3 Days Course is HRDC Claimable*!

Enjoy the most Attractive Price!

[ Register Now! ]

Government wants Malaysia to be more CANGGIH NATION & Stand Out from this RARE Opportunity…

Here’s what they are willing to do..

1. NEW I-ESG

MITI role out Sustainability Framework [i-ESG (National Industry Environmental, Social and Governance)] with spotlight on implementation of Sustainability by MSME TOO. SSM too launching theirs ROADSHOW. While BURSA move on to CSI System to target on SUSTAINABLE ESG SUPPLY CHAIN .

2. PADU Database

That’s not all, Rafizi roll out PADU too! This integrated Database allows for information to be shared among various arms of government.

3. E-Invoicing

Seriously, plus the E-Invoicing (covered in detail on Day 3 of the seminar) Malaysia really become a very “canggih” country, which is Driven by Real-Time DATA and moving into ESG, DIVERSITY AND INCLUSION, plus CARBON TRACKING. That MEANS you will see more efficient TAX COLLECTION, DATA DRIVEN TAX AUDIT and INVESTIGATION!

4. EV PRODUCER

Also, are you aware that Malaysia is able to produce 1,400 component for EV Vehicle? Yup, Malaysia ready to become Southeast Asian EV hub, Zafrul said so with confident. Plus, 5G FINALLY is at our doorstep.

5. Change in Tax Law

For all this to works, Government makes so many INTENTIONAL CHANGES to Tax Law this year. WE ARE SO EAGER TO SEE the FINANCE BILL.

What tax planning to expect in this NEW BUSINESS ERA? Malaysia is on a SURVIVE or DIE mode. Time for all of us to keep up and know what are the changes NOW. Remove all those TAX TROUBLE MAGNET before it is too late.

Enjoy the Lowest Price NOW.

Quick Facts

3 DAYS . PRACTICAL & LATEST TAX PLANNING STRATEGIES.

3 Q & A SESSIONS

Most comprehensive Tax Seminar of the Year. Covers All FIVE AREAS of BUDGET 2024: Tax Planning and E-Invoicing & SVDP 2.0

SPEAKER : Dr. CHOONG KWAI FATT

DATE : 13, 14, 15 December 2023 (Wed., Thurs. & Fri.) 👉 LAST 27 SEATS*

4, 5 & 6 December 2023 (Sold Out)

TIME: 9 AM TO 6 PM (21 CPD)

VENUE: THE GARDENS HOTEL, Mid Valley, Kuala Lumpur

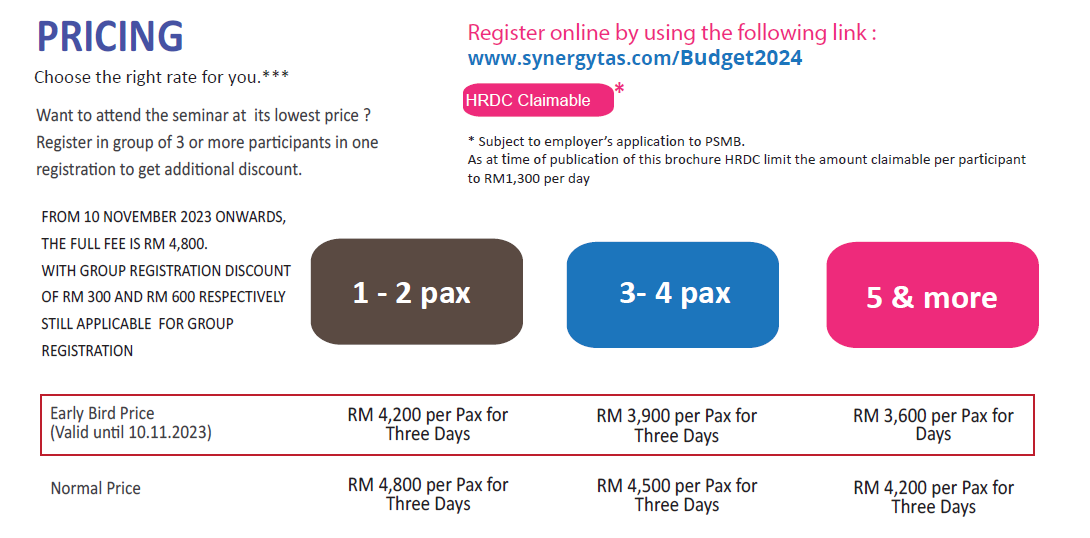

PRICE: See pricing below

(Early Bird Ends in 10 days)

*First-Comes, First Served basis

FIVE FACTORS

Why Our THREE DAYS Budget 2024 Seminar Standout

Session 2 LAST 27 SEATS*.

Grab the last seats for Session 2 before it gets sold out very very soon.